Our end of the year newsletter is packed with statistics for December, predictions for 2015, and an overview of 2014 as compared to 2013. Stable, consistent, normal increases are all descriptions for the current Abilene market.

I enjoy reading the predictions and then watching the actual occurrences. The 2014 Fannie Mae predictions were inaccurate while others performed as predicted. There are two predictions for 2015 that I continually see and I think will prove to be true.

These are from Forbes:

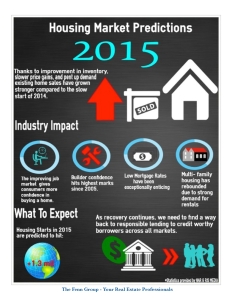

Rent increases will outpace home value growth: In 2015 many 25- 34-year-olds (Millennials) will form new households, but instead of buying they’ll rent, predicts Trulia’s Kolko. In part, this forecast is based on demographic factors (marriage, kids, cited above) and in part it’s because many of them will still need to save for a down payment. These factors will continue to push the demand for multi-family housing –and rents will keep rising. In fact, Humphries forecasts that rents will rise 3.5% in 2015, outpacing his predicted 2.5% for annual home price gains. This, in turn, may push some of those Millennials to become buyers. “As renters’ costs keep going up, I expect the allure of fixed mortgage payments and a more stable housing market will entice many more otherwise content renters into the housing market,” Humphries says.

Millennials will overtake Gen X as homebuyers: By the end of 2015, Millennials (those under the age of 35) will overtake Gen X (35-50 years old) to become the largest group of homebuyers in the U.S., predicts Zillow’s Humphries. “Roughly 42% of Millennials say they want to buy a home in the next one to five years, compared to just 31% of Generation X,” he says. “The lack of home-buying activity from Millennials thus far is decidedly not because this generation isn’t interested in homeownership, but instead because younger Americans have been delaying getting married and having children, two key drivers in the decision to buy that first home. As this generation matures, they will become a home-buying force to be reckoned with.”